Extract data from ESG reports

Extract structured ESG data from sustainability reports at scale. Automate CSRD, SFDR, and EU Taxonomy compliance with accurate extraction of environmental metrics, PAI indicators, and governance KPIs.

From ESG reports to investment-grade sustainability data

ESG reports from portfolio companies come in varied formats and frameworks, making it difficult to aggregate data for SFDR disclosures, CSRD compliance, or portfolio-wide ESG scoring. Manual extraction doesn't scale when managing hundreds of companies.

Raydocs extracts and structures ESG data from any report format — whether GRI, SASB, TCFD, or custom frameworks. Feed your ESG platform with clean, standardized data for regulatory reporting, financed emissions calculations, and portfolio benchmarking.

Capture essential fields, customize as needed

Description

Try out the demo

See how Raydocs extracts GHG emissions, PAI indicators, and EU Taxonomy metrics from any ESG report format.

ESG_Report.pdf

Available very soon

We're putting the finishing touches on our interactive demo. Stay tuned!

Scale ESG data collection across your portfolio

Collect ESG reports from portfolio companies, extract regulatory-ready data, and feed your ESG platform — all via API.

1Collect

Gather ESG reports from portfolio companies via drag-and-drop, email forwarding, or API. Process hundreds of reports in parallel, regardless of format or framework.

2Extract

Raydocs identifies and extracts GHG emissions, PAI indicators, Taxonomy metrics, and any custom KPIs — with source citations and confidence scores for audit trails.

3Integrate

Push structured data directly into your ESG platform via API, or export to Excel for SFDR disclosures, CSRD reporting, and LP communications.

Built for

privacy critical workflows

AES-256 encryption

EU or US data residency

Full audit trail for every document and data point

Backed by

responsive support

Personalized onboarding and template setup

Managed service by default, optional self-serve

Fast responses via Slack, email or support portal

Explore other templates

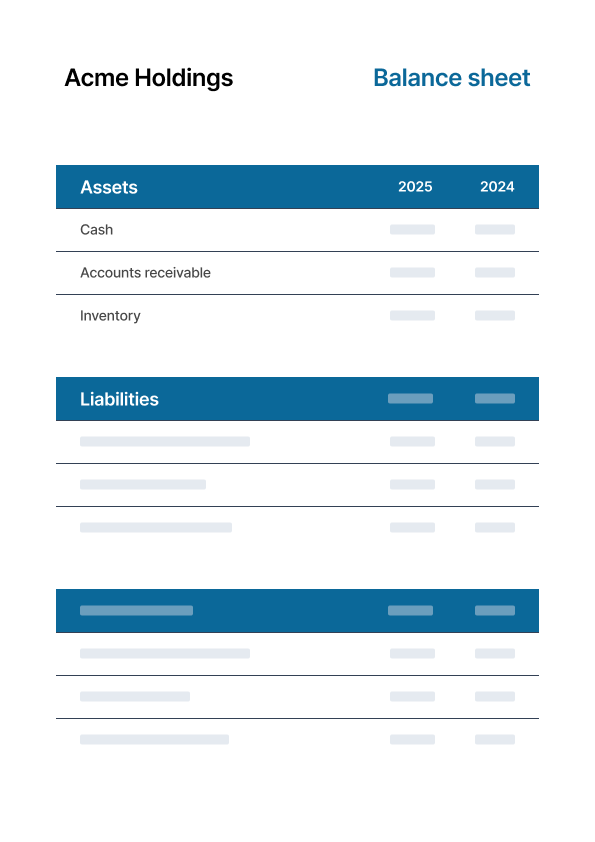

balance sheets

Automate financial statement processing with fast, accurate extraction of assets, liabilities, and equity data from balance sheets for streamlined financial analysis and reporting.

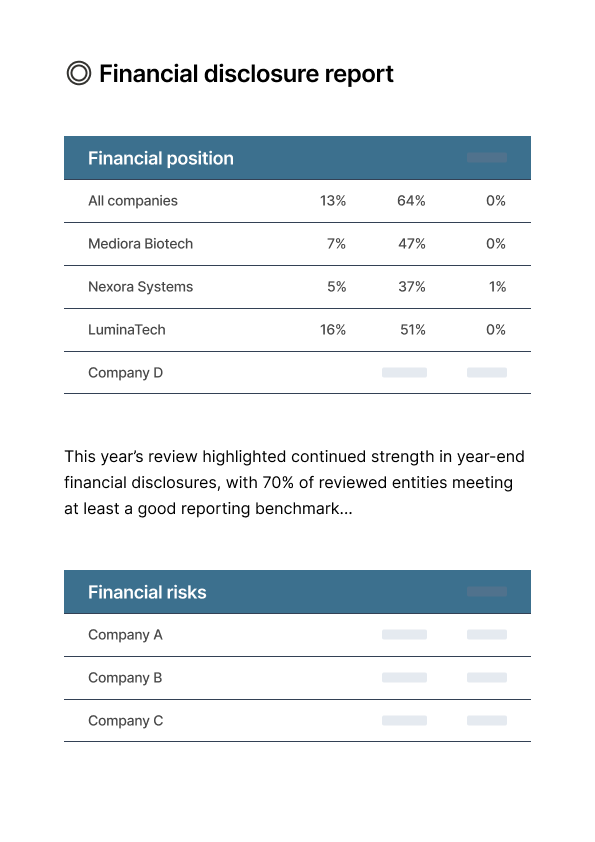

financial disclosure reports

Automate financial reporting with fast, accurate extraction of financial position, risks, and disclosure data from financial disclosure reports for streamlined compliance and analysis.

income statements

Automate financial statement processing with fast, accurate extraction of revenue, expenses, and profit metrics from income statements for streamlined financial analysis and reporting.

subscription agreements

Automate contract processing with fast, accurate extraction of subscription details, terms, and payment information from subscription agreements for streamlined business workflows.

Frequently asked questions

Does it work with scanned PDFs?

Yes—our built-in OCR technology processes scans, tables, and footnotes seamlessly.

How accurate is it?

We achieve 99%+ field-level accuracy on our benchmark set, and every extracted value displays its source for verification.

Does it handle industry-specific metrics?

Absolutely—our team will configure it to your needs.

Where is the data stored?

All data is processed and retained in EU data centres (US residency available on request).