AI-driven document intelligence for Private Equity

Process documents at scale with unmatched precision, without AI training. Raydocs reads your documents so your team can read the markets.

Q1 2025 Private Equity Portfolio Summary

Horizon Growth Partners II delivered solid performance in Q1 2025, with a fund size of $1,200,000,000 and TVPI of 1.62x

Portfolio overview

| Company | Sector | FMV (Q1) |

|---|---|---|

| Medivio Health | $38.1M | |

| BlueCreate Inc. | $10.6M | |

$1,200M

1.62x

Built for Private Equity professionals

Whether it's LP reporting, ESG compliance, or due diligence — Raydocs accelerates your workflows.

EBIDTA

€894Msource

Quarterly reports from thousands of investments with inconsistent layouts.

Financial statements · Management reports · GP portfolio valuation · Capital accounts

Extract unlimited data points per document.

Income statement · Balance sheet items · Industry specific KPIs · Distributions · Fee waterfalls · Recallable capital · Any other fields monitored by your team

Say goodbye to manual data extraction

Ingest documents at scale, extract key data points, and export with ease. Everything can be done via API.

1Ingest

Drag-and-drop files, email, sync a secure folder, or use our API. Raydocs ingests unlimited files in one go.

2Analyze

Raydocs structures each document, applies your extraction template, and captures every required data point—complete with source links and confidence scores. All accessible via API.

3Export

Export to Excel or stream the structured data straight into your analytics and business systems via API for instant reporting and insight.

Why leading PE teams trust Raydocs

Purpose-built for unstructured data in Private Equity — no setup, no templates, full compliance.

Understands complex, unstructured documents

Raydocs extracts meaning from messy and varied fund materials — no setup required.

- No templates or training required for AI models

- Handles unknown document formats, tables, footnotes and nested structures

- Extracts KPIs, financials, ESG, cash flows, and legal terms with full context

- Correlates data across multiple documents

Works at scale, across formats and systems

Raydocs integrates into your workflows and processes large volumes efficiently.

- Accepts PDFs, Excel files, scanned files, images, email attachments, synced folders

- Supports bulk uploads and ongoing ingestion

- Outputs structured data into files or systems like Snowflake, eFront, Excel, Dynamo, Allvue and more

Built for Private Equity and Enterprise use

Raydocs is tailored for the needs, scale, and regulatory standards of PE firms

- AI models fine-tuned for fund finance, ESG, and LP reporting

- Full audit trail, AES-256 encryption, and EU/US data residency

- Built by professionals with deep expertise in private markets

- Updated with evolving PE compliance frameworks

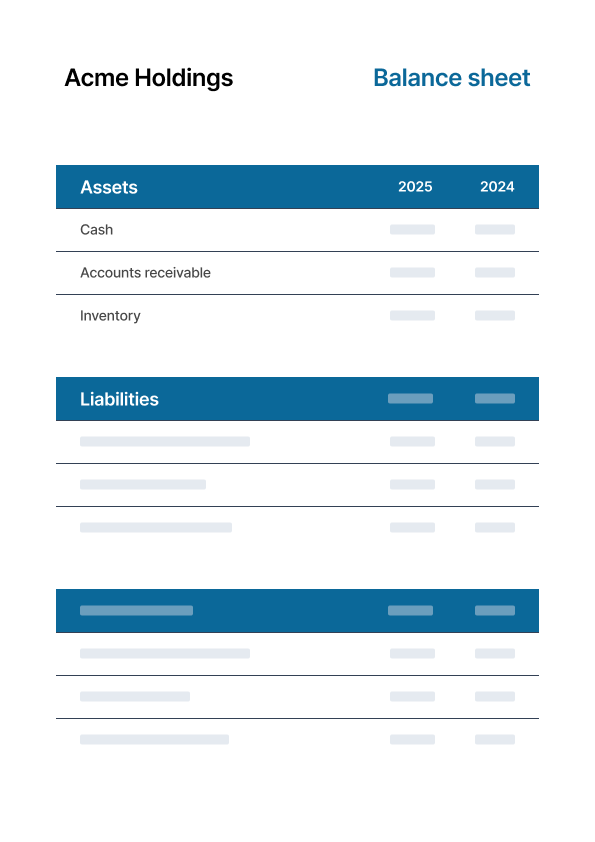

Financial document templates

Ready-made templates for financial statements, bank statements, balance sheets, and more financial documents.

balance sheets

Automate financial statement processing with fast, accurate extraction of assets, liabilities, and equity data from balance sheets for streamlined financial analysis and reporting.

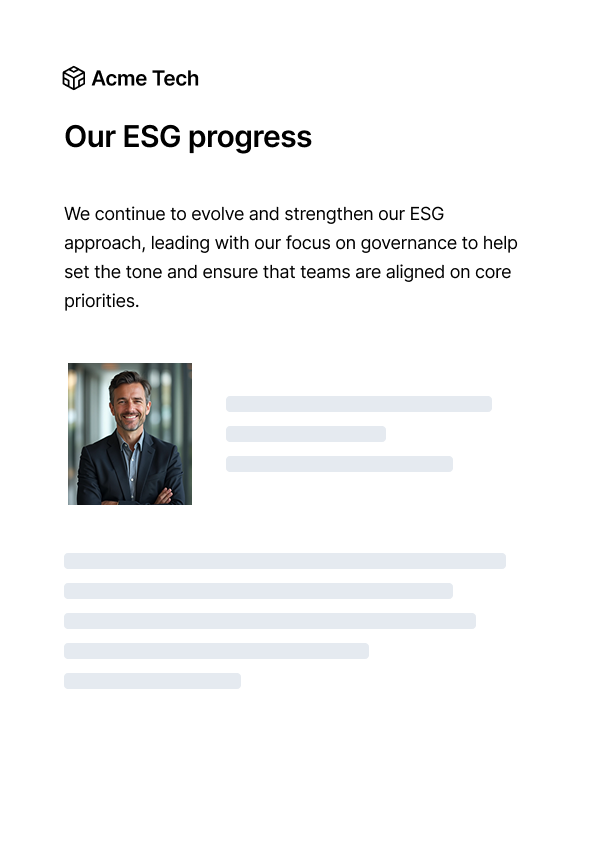

ESG reports

Extract structured ESG data from sustainability reports at scale. Automate CSRD, SFDR, and EU Taxonomy compliance with accurate extraction of environmental metrics, PAI indicators, and governance KPIs.

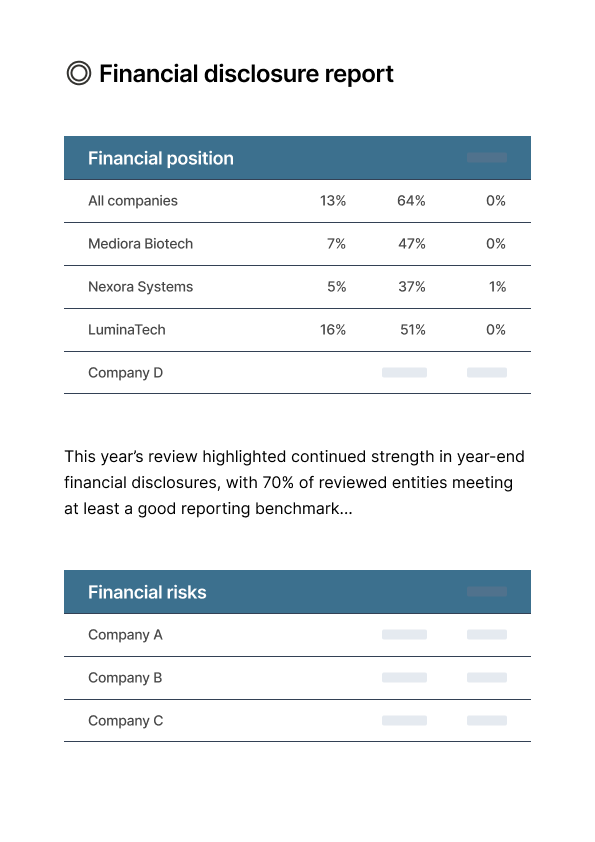

financial disclosure reports

Automate financial reporting with fast, accurate extraction of financial position, risks, and disclosure data from financial disclosure reports for streamlined compliance and analysis.

income statements

Automate financial statement processing with fast, accurate extraction of revenue, expenses, and profit metrics from income statements for streamlined financial analysis and reporting.

Get started with Raydocstoday

Request a demo with us and start saving time and money with your document processing.